Superior

Credit Doc Analysis

So you can focus on strategy.

BUILT FOR INSTITUTIONS

Platform Preview

Full copilot for credit review

How it Works

On-demand analysis of credit documents

Upload

Upload the credit document you wish to review.

Analysis

CreditGPT analyzes the document across myriad dimensions.

Results

Receive instant, comprehensive credit analysis.

Outputs (pt.1)

Key clauses extracted and structured

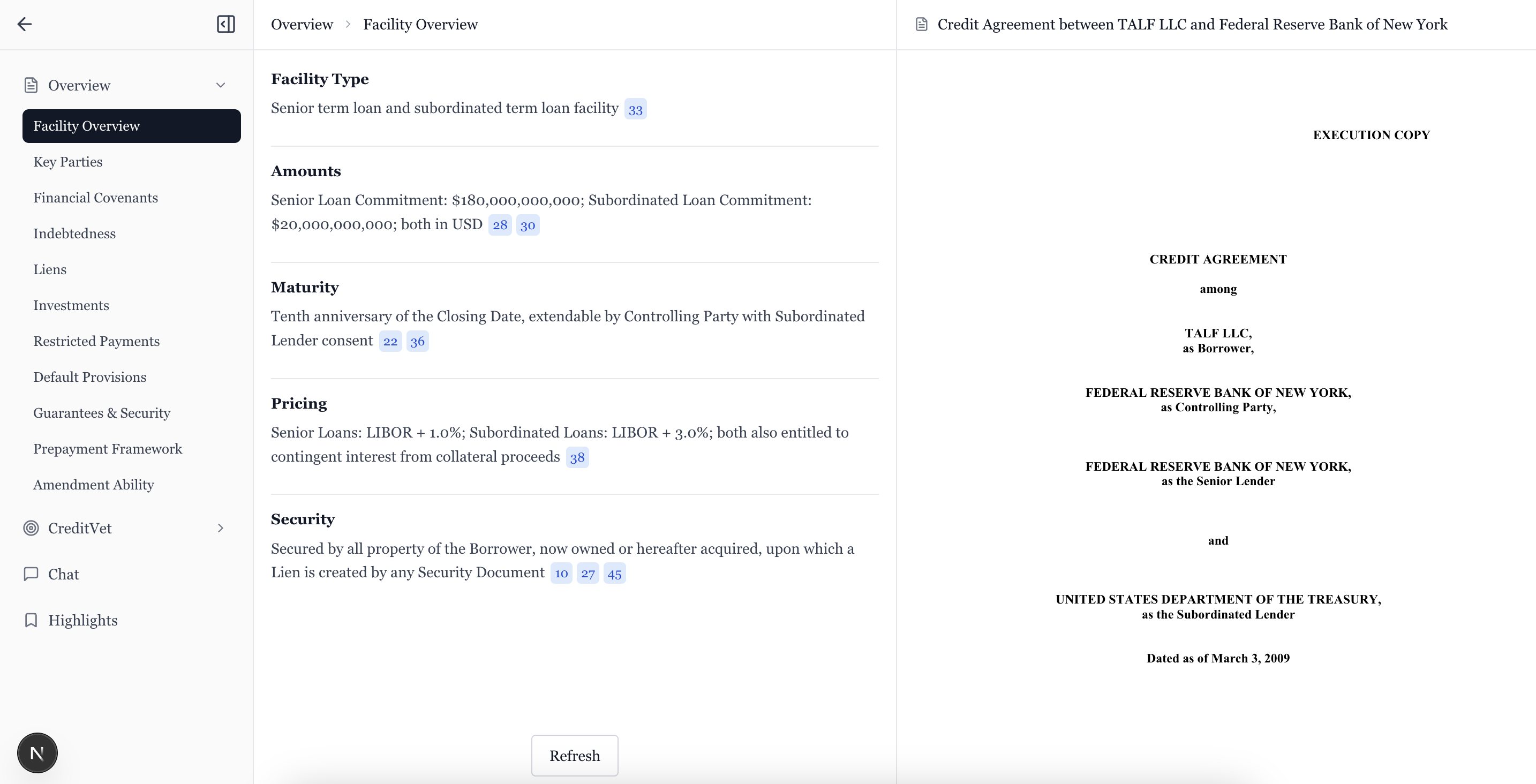

Facility Overview

Core facility structure, amounts, pricing, collateral

Key Parties

Borrower, lenders, agents, guarantors, etc.

Financial Covenants

Leverage ratios, coverage ratios, and maintenance requirements

Indebtedness

Permitted debt categories, subordination terms, and debt limitations

Liens

Security interests, collateral requirements, and lien priorities

Investments

Permitted investment types, joint ventures, and acquisition restrictions

Restricted Payments

Dividend limitations, distribution caps, and payment restrictions

Default Provisions

Events of default, cross-default provisions, and cure periods

Guarantees & Security

Pledged assets, guarantees, and security package details

Prepayment

Mandatory prepayments, optional prepayments, and penalties

Outputs (pt.2)

Capital structure strategy and risk assessments

Senior Priming Debt

Low Risk"Indebtedness covenant explicitly prohibits any debt senior to existing facilities"

Uptier Exchange

High Risk"No restrictions on exchanges or amendments with majority lender consent"

Unrestricted Sub Transfer

Medium Risk"Investment basket allows transfers up to $50M to unrestricted subsidiaries"

Drop-Down Financing

High Risk"No limitations on subsidiary debt or restrictions on asset transfers"

Open-Market Buyback

Low Risk"Buybacks limited to $25M annually and must be offered pro rata"

Dividend Recaps

High Risk"Restricted payments basket allows unlimited dividends if leverage test met"

Asset Stripping

High Risk"Asset sale covenant contains broad carveouts with minimal reinvestment requirements"

Double-Dip Financing

Medium Risk"Permitted liens allow additional secured debt with shared collateral up to $100M"

EBITDA Add-Backs

Medium Risk"Uncapped synergy add-backs with 24-month realization period"

PIK Toggle Interest

Medium Risk"Optional PIK payments allowed if liquidity falls below $50M threshold"

Springing Liens

Low Risk"Springing liens only trigger upon severe covenant breach with 30-day cure period"

Sale-Leaseback

Medium Risk"Sale-leaseback transactions permitted up to $75M with fair market value requirement"

Institutional Benefits

Move faster with deeper insights

Move Faster

Analyze docs quickly

Uncover Risks

Identify what others miss

Generate Alpha

Invest with an edge

Win More Mandates

Grow your business